California Investment Properties in 2026: Strategic Insights for the Sophisticated Investor

- The SUMMANTIS Strategic Advisory Team

- Jan 8

- 6 min read

By Summantis Strategic Advisory | January 2026

The California real estate investment landscape in 2026 presents something many investors haven't experienced in years: predictability. After several years of volatility, rising rates, and market uncertainty, the Golden State is entering what experts are calling "The Great Housing Reset"—a period of stabilization that rewards strategic positioning over speculative timing.

But predictability doesn't mean simplicity. California's $3 trillion economy, diverse markets, and evolving regulatory landscape demand a nuanced approach. At Summantis, we believe that understanding the architecture of opportunity is what separates reactive investors from those who build generational wealth.

Here's what the data reveals—and what it means for your investment strategy in 2026.

The State of the Market: Stability Without Stagnation

The California Association of Realtors projects the statewide median home price will reach $905,000 in 2026, representing modest 3.6% growth. Home sales are expected to increase by approximately 2%, signaling renewed market activity without the frenzy of past cycles.

This isn't a boom. It's something better: a market where fundamentals matter again.

Key Market Indicators:

Mortgage rates: Averaging 6.0-6.3%, down from 6.6% in 2025

Inventory: Up nearly 10% year-over-year, providing more selection

Affordability: Improving to 18% (percentage of households that can afford median-priced homes)

Days on market: Properties are moving faster—well-priced homes attract quick offers

Rental demand: Remaining robust as homeownership remains cost-prohibitive for many

What This Means for Investors:

The compression of volatility creates opportunity for those who understand market mechanics. Lower rates improve cash flow projections. Increased inventory allows for selectivity. And modest appreciation provides equity growth without the risk of bubble dynamics.

The Regulatory Shift: Senate Bill 79 and Transit-Oriented Development

One of the most significant developments for 2026 is California Senate Bill 79, the "Abundant and Affordable Homes Near Transit Act," signed into law in October 2025.

This legislation removes local zoning barriers that historically prevented high-density residential development near existing transit infrastructure. While it doesn't mandate construction, it eliminates municipal roadblocks that have constrained supply in high-demand metros.

Strategic Implication:

Properties near transit corridors—particularly in the Bay Area, Los Angeles, and San Diego—may see accelerated development activity. For investors, this signals potential appreciation in transit-adjacent markets and opportunities in multi-family development or land acquisition plays.

However, SB 79 doesn't guarantee immediate affordability gains. The timeline from zoning approval to completed construction spans years. Patient capital positioned in the right submarkets stands to benefit as these dynamics unfold.

Regional Divergence: Where the Smart Money is Moving

California is not a monolith. The performance gap between coastal markets and inland regions continues to define investment strategy in 2026.

Coastal Markets: Premium Positioning, Moderate Growth

Bay Area (San Francisco, San Jose, Palo Alto):

Zillow forecasts modest price declines of 1.6% through late 2026 for San Francisco

San Jose showing slightly stronger resilience

Tech sector stabilization supporting high-end rental demand

Vacancy rates at 4.8% in Los Angeles, well below national average of 6%

Investor Playbook: Coastal markets reward buy-and-hold strategies focused on long-term appreciation and premium rental yields. These aren't cash flow plays—they're wealth preservation and equity accumulation strategies.

Inland Markets: Yield-Focused Opportunities

Central Valley (Fresno, Bakersfield, Sacramento):

Bakersfield cap rates: 6.84-7.10% (significantly higher than coastal markets)

Average Bakersfield rent: $1,189-$1,386

Home values up 4.6% year-over-year

Population growth driving sustained rental demand

Inland Empire (Riverside, San Bernardino):

Median rents: $1,852 in San Bernardino, up 9% year-over-year

Population projected to reach 3.6 million by 2060

Strong migration from coastal areas seeking affordability

High occupancy rates supporting consistent cash flow

Investor Playbook: Inland markets offer superior cash-on-cash returns, lower barriers to entry, and strong demographic tailwinds. These are the markets where strategic investors build portfolios at scale.

The Multifamily Advantage: Why Apartments Outperform in 2026

Multifamily real estate is the highest-rated investment property type heading into 2026, according to the Urban Land Institute and PwC's Emerging Trends report.

Why Multifamily Dominates:

Structural Supply Deficit: The U.S. has a 600,000-unit apartment shortage, with California experiencing acute undersupply in most metros

Declining Construction Starts: Multifamily starts fell 40% between 2023-2025, creating a more favorable supply-demand balance for existing properties

Rental Affordability Advantage: The gap between renting and homeownership costs remains extraordinarily wide, supporting occupancy rates above 94%

Capitalization Rate Compression: National multifamily cap rates averaging 5.6%, with expectations for further compression as deal volume increases

Wage Growth Outpacing Rent Growth: For the first time in years, wages are rising faster than rents, improving tenant retention and reducing vacancy risk

Strategic Focus Areas:

Workforce Housing (60-100% AMI): Institutional investors are prioritizing attainable housing as both financially defensive and socially impactful

Value-Add Opportunities: Properties requiring moderate improvements can capture rent premiums in supply-constrained markets

Transit-Adjacent Assets: SB 79 tailwinds position these properties for long-term appreciation

The Capital Markets Reality: Financing is Easing, But Discipline Matters

After two years of elevated borrowing costs and lender caution, the financing environment in 2026 is showing renewed stability.

What's Improving:

Transaction Volume: Up 40% year-over-year in Q3 2025

Lender Appetite: Banks returning to commercial real estate lending

Bond Market Signals: Corporate-government bond yield spread narrowing to ~1 percentage point

Cap Rate Stabilization: Seven quarters of steady 5.7% cap rates may give way to gradual compression

What Hasn't Changed:

Underwriting Rigor: Lenders demand stronger borrower profiles and reserves

Rate Sensitivity: Even at 6%, mortgage costs remain elevated vs. 2020-2021

Market Selectivity: Not all markets or property types receive equal financing treatment

Summantis Perspective:

Access to capital in 2026 isn't about luck—it's about strategic positioning. Investors who structure their financial profiles with precision, demonstrate cash flow stability, and present compelling market narratives will access capital. Those who don't, won't.

This is where fundability engineering becomes the differentiator.

The Risk Factors You Can't Ignore

No market analysis is complete without acknowledging downside scenarios. Here's what could disrupt the 2026 outlook:

1. Economic Slowdown: Unemployment rises or wage growth stalls, reducing tenant ability to pay rent and dampening buyer demand.

2. Insurance Cost Escalation: California's wildfire and climate risks continue driving insurance premiums higher, eroding property cash flow and investor returns.

3. Interest Rate Volatility: If Treasury yields spike unexpectedly, mortgage rates could rise again, dampening affordability gains and transaction activity.

4. Policy Uncertainty: Changes to immigration policy could impact construction labor costs and rental demand in certain markets.

5. Overconcentration in Supply-Heavy Markets: Markets like Austin, Phoenix, and parts of Florida are still working through oversupply. California investors eyeing out-of-state opportunities must underwrite carefully.

Mitigation Strategy:

Diversification across property types, geographic markets, and tenant profiles reduces concentration risk. Stress-testing cash flow projections with conservative assumptions—higher vacancy, rising expenses, rate fluctuations—separates sustainable investments from fragile ones.

The Summantis Investment Framework for 2026

At Summantis, we approach California real estate investment through three strategic lenses:

1. Cash Flow vs. Appreciation: Know Your Strategy

Cash Flow Plays:

Inland markets (Bakersfield, Fresno, Riverside, San Bernardino)

Multi-family properties with strong rent-to-price ratios

Value-add opportunities with immediate NOI improvement potential

Appreciation Plays:

Coastal markets (SF Bay Area, Los Angeles, San Diego)

Transit-adjacent properties positioned for SB 79 upside

High-barrier-to-entry markets with limited new supply

Hybrid Plays:

Sacramento, Stockton, and secondary coastal markets

Balance of moderate cash flow with appreciation potential

2. Underwrite for Reality, Not Optimism

The 2026 market rewards disciplined underwriting:

Stress-test for 10-15% vacancy

Model property tax and insurance increases at 3-5% annually

Factor in CapEx reserves of $300-500/unit/year for multifamily

Assume mortgage rates stay elevated; treat rate drops as upside, not baseline

Evaluate exit strategies with multiple scenarios (hold, 1031 exchange, refinance)

3. Capital Positioning is the Unlock

In 2026, access to deals matters as much as finding them:

Fundability Engineering: Structure your personal and business credit to qualify for commercial financing

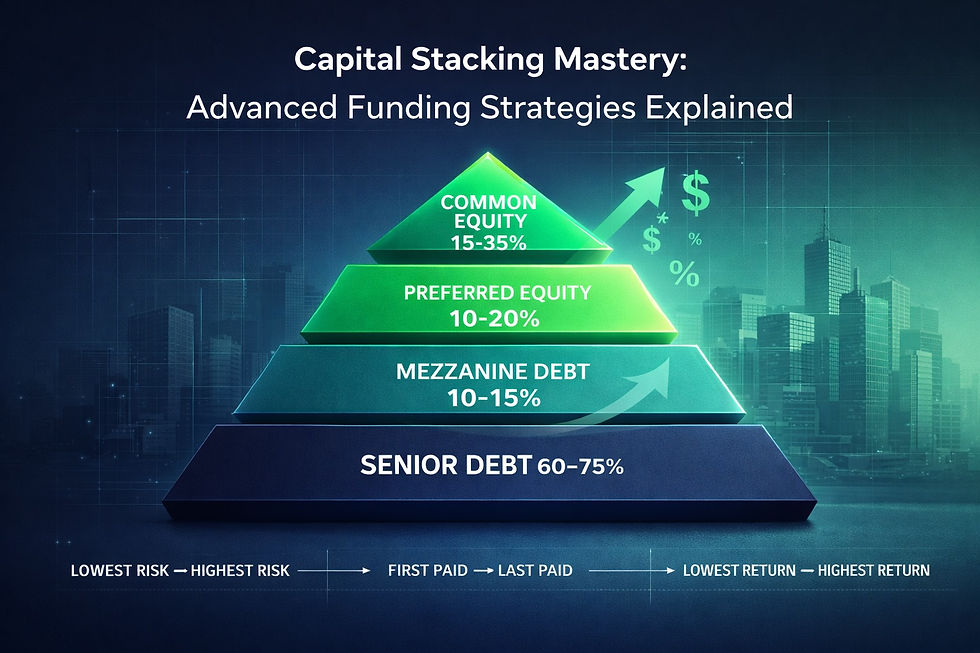

Capital Stacking: Layer debt, mezzanine financing, and equity strategically to maximize leverage without overleveraging

Relationship Capital: Cultivate lender relationships before you need them

Liquidity Reserves: Maintain 6-12 months of operating reserves to weather market shifts

The Bottom Line: 2026 Rewards the Strategist, Not the Speculator

California real estate investment in 2026 isn't about catching lightning in a bottle. It's about understanding market architecture, positioning capital strategically, and executing with precision.

The opportunities are real:

Moderate price growth providing equity accumulation

Strong rental demand supporting cash flow

Improving financing conditions expanding accessibility

Regulatory shifts creating long-term upside in transit markets

Multifamily fundamentals offering defensive, yield-stable investments

But opportunity without strategy is just noise.

At Summantis, we don't believe prosperity is accidental. We believe it's designed—through clarity about market mechanics, strategy in capital deployment, and precision in execution.

Whether you're evaluating your first investment property or scaling a multi-million dollar portfolio, the question isn't whether California offers opportunity in 2026. The question is whether you're positioned to capitalize on it.

Ready to Design Your Real Estate Investment Strategy?

Summantis Strategic Advisory, led by Founder & CEO María Elena Hernández, specializes in helping investors, entrepreneurs, and business owners structure their capital, optimize their portfolios, and execute with confidence.

With over three decades of experience in real estate investment, business strategy, and capital structuring, Elena and her team of experts provide the precision guidance that turns market knowledge into measurable results—from fundability engineering and capital access to portfolio strategy and exit planning.

Whether you're analyzing your first investment property or scaling a multi-million dollar portfolio, Elena Hernández brings the strategic clarity and execution framework that transforms opportunity into legacy.

Schedule Your Strategic Consultation with Elena Hernández:

📞 (661) 213-9152🌐 www.summantis.com

Summantis. Prosperity Designed.

Sources & Data References:

California Association of Realtors (C.A.R.) 2026 Housing Market Forecast

Urban Land Institute / PwC Emerging Trends in Real Estate 2026

Zillow Housing Market Forecasts

National Multifamily Housing Council

California Department of Housing and Community Development

First American Potential Cap Rate Model

Redfin 2026 Market Predictions

Disclaimer: This analysis is for informational purposes only and does not constitute financial, legal, or investment advice. Real estate investments carry risk, and past performance does not guarantee future results. Consult with qualified financial and legal professionals before making investment decisions.

Comments