Capital Stacking Mastery: Advanced Funding Strategies Explained

- The SUMMANTIS Strategic Advisory Team

- 4 days ago

- 12 min read

By María Elena Hernández, CEO & Founder, Summantis | January 2026

The difference between investors who scale and those who stagnate isn't capital availability—it's capital architecture.

After 30+ years of structuring commercial and real estate transactions worth over $200 million, I've observed a consistent pattern: sophisticated investors don't just seek funding. They engineer it. They understand that how you layer capital matters as much as how much capital you raise.

This is the art and science of capital stacking—the strategic structuring of multiple financing sources to maximize leverage, minimize cost of capital, and optimize returns. It's the difference between owning one property and building a portfolio. Between securing a single loan and architecting an empire.

In this comprehensive guide, I'll break down the capital stack framework, reveal the mechanics that institutional investors use daily, and show you how to position yourself to access capital most investors never knew existed.

What is Capital Stacking? Understanding the Foundation

The capital stack is the hierarchical structure of all funding sources used to finance a commercial real estate transaction or business acquisition. Think of it as a layered financial blueprint where each layer represents a different type of capital, each with its own risk profile, cost, priority of repayment, and potential return.

At its core, the capital stack answers three critical questions:

Who gets paid when? (Priority waterfall)

Who bears what risk? (Risk allocation)

Who earns what return? (Return distribution)

Unlike traditional single-source financing—where you simply take out a mortgage or business loan—capital stacking combines multiple funding sources to create a customized financial structure tailored to the specific deal, risk tolerance, and return objectives of all stakeholders.

Why This Matters:

Understanding the capital stack transforms you from a borrower who accepts whatever terms lenders offer into a strategic architect who designs optimal financing structures. It's the difference between reactive and intentional capital deployment.

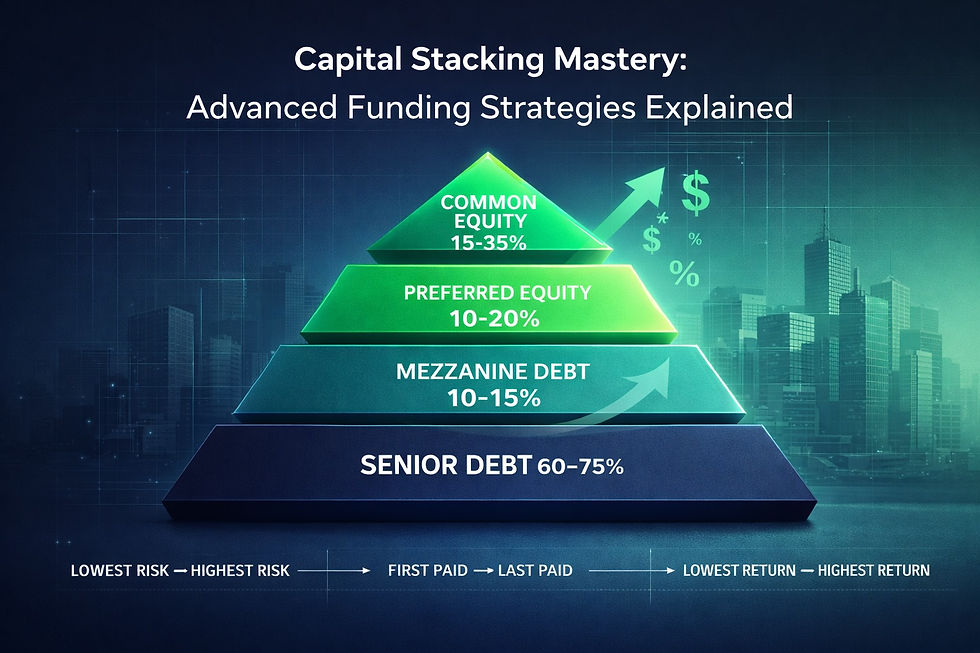

The Four Layers of the Capital Stack: From Foundation to Peak

The traditional commercial real estate capital stack consists of four primary layers, each occupying a specific position in the repayment hierarchy. From lowest to highest risk (and corresponding return potential):

Layer 1: Senior Debt (The Foundation)

Position: Bottom of the stack Typical LTV: 60-75% of property value Interest Rate Range: 5-8% annually (market-dependent) Risk Profile: Lowest Return Profile: Fixed, predictable

Senior debt is typically provided by commercial banks, credit unions, or institutional lenders. It's secured by a first-position lien on the property, meaning if the deal goes south, senior debt holders are first in line for repayment.

Key Characteristics:

Lowest cost of capital in the stack

Requires strongest borrower qualifications

Subject to strict underwriting criteria including:

Loan-to-Value (LTV) ratios: Typically capped at 75-80%

Debt Service Coverage Ratio (DSCR): Minimum 1.20-1.25x (property income must exceed debt payments by 20-25%)

Debt Yield: Minimum 8-12% (NOI divided by total loan amount)

Real-World Example:

A $10 million multifamily acquisition:

Senior debt: $7.5 million (75% LTV)

Interest rate: 6.5%

Amortization: 25-30 years

Annual debt service: ~$611,000

The senior lender is primarily concerned with one thing: getting repaid. They analyze cash flow stability, borrower creditworthiness, and asset quality to minimize default risk.

Layer 2: Mezzanine Debt (The Bridge)

Position: Second tier Typical Range: 10-15% of capital stack Interest Rate Range: 9-15% annually Risk Profile: Moderate Return Profile: Fixed, higher than senior debt

Mezzanine debt fills the gap between senior debt and equity. It's subordinate to senior debt but senior to all equity, occupying the critical middle position in the stack.

Key Characteristics:

Secured by a second-position lien or equity pledge (not the property itself)

Higher interest rate compensating for increased risk

Faster repayment timeline (3-7 years typical)

More flexible underwriting than senior debt

Often includes equity participation (warrants, profit participation)

Why Investors Use Mezzanine Debt:

Mezzanine financing allows sponsors to reduce the equity requirement without overleveraging the senior debt position. If senior debt provides 70% and you need to keep equity below 25%, mezzanine debt bridges that 5% gap.

Real-World Example:

Continuing our $10 million acquisition:

Senior debt: $7 million (70% LTV)

Mezzanine debt: $1 million (10%)

Interest rate: 12%

Term: 5 years

Annual debt service: ~$120,000

Mezzanine lenders accept higher risk because they're compensated with higher returns. They're betting on the sponsor's execution ability and the property's value appreciation.

Layer 3: Preferred Equity (The Sweetener)

Position: Third tier Typical Range: 10-20% of capital stack Return Rate: 8-15% (often structured as preferred return) Risk Profile: Moderate-High Return Profile: Preferred distribution before common equity

Preferred equity occupies the space between debt and common equity. Investors receive a predetermined preferred return (often 8-12% annually) before common equity holders receive any distributions.

Key Characteristics:

Not debt (no mandatory repayment schedule)

Not senior ownership (subordinate to all debt)

Receives distributions after all debt but before common equity

Often includes equity upside participation after preferred return is met

Offers more flexibility than debt (can defer payments in cash flow-constrained scenarios)

Strategic Use Cases:

Preferred equity is particularly valuable when:

Senior debt LTV limits leave a funding gap

Sponsor wants to minimize common equity dilution

Deal requires flexible capital that doesn't create debt service pressure

Investors seek equity-like returns with debt-like priority

Real-World Example:

Our $10 million acquisition evolves:

Senior debt: $6.5 million (65% LTV)

Mezzanine debt: $1 million (10%)

Preferred equity: $1.5 million (15%)

Preferred return: 10% annually

Distributions: Preferred equity receives first $150,000 annually after debt service

Preferred equity investors sacrifice the unlimited upside of common equity in exchange for priority and reduced risk.

Layer 4: Common Equity (The Apex)

Position: Top of the stack Typical Range: 15-35% of capital stack Return Potential: Unlimited (uncapped upside) Risk Profile: Highest Return Profile: Variable, residual after all other obligations

Common equity represents true ownership. Sponsors and investors at this level bear the highest risk but enjoy unlimited upside potential.

Key Characteristics:

Last to receive distributions (residual cash flow)

First to absorb losses in underperformance or default

Unlimited profit potential if property outperforms

No fixed return or mandatory distributions

Full alignment with deal success

Return Mechanics:

Common equity returns come from two sources:

Cash flow distributions: After all debt payments and preferred returns

Capital appreciation: Profit upon sale or refinance

Real-World Example:

Completing our $10 million stack:

Senior debt: $6.5 million (65%)

Mezzanine debt: $1 million (10%)

Preferred equity: $1.5 million (15%)

Common equity: $1 million (10%)

If the property generates $800,000 in annual NOI:

Senior debt service: ~$530,000

Mezzanine debt service: ~$120,000

Preferred equity return: $150,000

Residual to common equity: $0 (in Year 1, assuming stabilization)

But if NOI grows to $1.2 million by Year 3:

Total debt service: $650,000

Preferred return: $150,000

Residual to common equity: $400,000 (40% cash-on-cash return on $1M investment)

And if the property sells for $15 million after 5 years:

Senior debt payoff: ~$6.2 million

Mezzanine payoff: $1 million

Preferred equity return of capital: $1.5 million

Remaining for common equity: $6.3 million (6.3x return on $1M investment)

This is why sophisticated sponsors structure deals with layered capital—it creates asymmetric upside for common equity when deals perform.

The Summantis Capital Stacking Framework: Strategic Structuring Principles

After three decades of structuring transactions across market cycles, I've developed a framework for optimal capital stack design. Here are the strategic principles:

Principle 1: Maximize Leverage Without Maximizing Risk

The goal isn't to use the most leverage possible—it's to use the most intelligent leverage possible.

Optimal LTV Ranges by Property Type:

Stabilized multifamily: 70-75% senior debt

Value-add multifamily: 65-70% senior debt

Stabilized commercial (office, retail, industrial): 65-70%

Development projects: 50-60% senior debt + significant equity

Why This Matters:

Pushing LTV above 75-80% often triggers:

Higher interest rates

Stricter loan covenants

Reduced lender flexibility

Increased default risk if markets soften

Strategic Approach:

Target 65-70% senior debt, layer 10-15% mezzanine or preferred equity, and retain 20-25% common equity. This structure:

Keeps senior debt comfortable (strong DSCR)

Fills the gap with strategic mezzanine/preferred capital

Maximizes common equity returns through leverage

Maintains flexibility if cash flow tightens

Principle 2: Match Capital Sources to Deal Stage

Different stages of a real estate lifecycle demand different capital structures.

Acquisition:

Senior debt: 70-75%

Equity: 25-30%

Focus: Low-cost capital, fast closing

Stabilization/Value-Add:

Senior debt: 65-70%

Mezzanine/Preferred: 10-15%

Common equity: 20-25%

Focus: Flexible capital for improvements, patient equity partners

Refinance:

Senior debt: 75-80% (based on increased NOI and value)

Equity recapture: Return capital to common equity holders

Focus: Harvest gains while maintaining ownership

Development:

Construction debt: 50-60%

Mezzanine: 10-15%

Equity: 30-40%

Focus: Flexibility, staged funding, experienced equity partners

Principle 3: Align Capital Costs with Return Potential

Every layer of the capital stack has a cost—interest payments, preferred returns, equity dilution. Strategic structuring minimizes blended cost of capital while maximizing returns.

Calculating Weighted Average Cost of Capital (WACC):

Using our $10 million example:

Senior debt ($6.5M @ 6.5%): $422,500 annual cost

Mezzanine ($1M @ 12%): $120,000 annual cost

Preferred equity ($1.5M @ 10%): $150,000 annual cost

Common equity ($1M @ expected 15%+ IRR): Variable

Blended cost: ($422,500 + $120,000 + $150,000) / $10M = 6.93% WACC

If the property's unlevered cap rate is 6.5%, this structure doesn't work—you'd be paying more for capital than the property earns. But if the cap rate is 7.5-8%, or if value-add improvements push NOI higher, the spread creates profit.

Strategic Insight:

Sophisticated investors model multiple capital stack scenarios to find the structure that maximizes equity returns while maintaining downside protection.

Principle 4: Stress-Test the Stack for Downside Scenarios

The capital stack that looks brilliant in a pro forma can become catastrophic in a downturn. Always stress-test your structure.

Key Stress Scenarios:

10-15% NOI decline: Can you still cover all debt service?

Interest rate spike: If you have floating-rate debt, can you handle a 200-300 basis point increase?

Extended vacancy: Can you survive 6-12 months at 70% occupancy?

Exit cap rate expansion: What if you have to sell at a 100-150 basis point higher cap rate than you underwrote?

Defensive Structuring:

Maintain DSCR above 1.30x (not just 1.20x minimum)

Build 6-12 months of operating reserves

Negotiate interest rate caps on floating debt

Structure mezzanine with payment flexibility (PIK toggles)

Retain enough equity cushion to absorb value declines

Advanced Capital Stacking Strategies: Beyond the Basics

Once you've mastered traditional capital stacking, these advanced strategies separate truly sophisticated operators from the rest:

Strategy 1: Intercreditor Structuring

When using multiple debt sources (senior + mezzanine), the intercreditor agreement defines each lender's rights in default scenarios. Strategic sponsors negotiate terms that:

Allow mezzanine lenders to "cure" senior debt defaults

Provide mezzanine with limited recourse rights

Create standstill periods before foreclosure actions

Preserve sponsor equity even in distress scenarios

This isn't about planning for failure—it's about preserving optionality when markets shift.

Strategy 2: Syndicated Equity Structures

Rather than raising all equity from a single source, sophisticated sponsors create tiered equity offerings:

Class A (Common) Equity:

70% LP / 30% GP profit split after preferred return

Targeted to institutional investors or family offices

Minimum investment: $500K-$1M

Class B (Common) Equity:

80% LP / 20% GP profit split after preferred return

Targeted to accredited individual investors

Minimum investment: $50K-$100K

This structure allows sponsors to access different investor pools while maintaining alignment.

Strategy 3: Promote Structures (GP Carried Interest)

General partners (sponsors) typically contribute 5-10% of equity but receive disproportionate profit participation through promotes:

Example Waterfall:

First tier: All investors receive 8% preferred return

Second tier: Investors receive return of capital

Third tier: 70/30 split until investors achieve 12% IRR

Fourth tier: 50/50 split on all remaining profits

This structure aligns sponsor interests with performance while compensating them for deal sourcing, execution, and asset management.

Strategy 4: Cross-Collateralization & Portfolio Lending

Instead of financing each property individually, portfolio lenders allow you to cross-collateralize multiple assets:

Benefits:

Higher aggregate LTV (70-75% vs. 65-70% on single assets)

Stronger performing properties offset weaker ones

Single debt service obligation (operational efficiency)

Lower blended interest rate

Risks:

Default on one property can trigger default on all

Difficult to sell individual assets (must refinance entire portfolio)

Lender has more leverage in negotiations

Strategic Use:

Cross-collateralization works best for stabilized portfolios you intend to hold long-term (7+ years) where the efficiency gains outweigh the flexibility trade-offs.

Fundability Engineering: Positioning Yourself for Capital Access

Understanding capital stacking is academic unless you can actually access the capital. This is where fundability engineering becomes critical.

Most investors never get the capital they need—not because they don't qualify, but because they don't know how lenders think or how to position themselves strategically.

The Three Pillars of Fundability:

1. Personal Financial Profile Optimization

Credit score: 680+ minimum, 720+ competitive, 760+ optimal

Debt-to-income ratio: Below 43% for best terms

Liquidity reserves: 6-12 months of debt service + operating expenses

Track record documentation: Previous deals, exits, performance metrics

2. Entity Structure & Business Credit

Properly structured legal entities (LLC, LP structures)

Separate business credit profiles from personal

Business tax returns demonstrating profitability

Operating agreements that satisfy lender requirements

3. Deal Positioning & Presentation

Professional underwriting packages

Conservative but compelling pro formas

Third-party validations (appraisals, market studies, environmental reports)

Clear value-creation thesis

Credible exit strategy

The Summantis Approach:

We work with clients 6-12 months before they need capital, structuring their financial profiles to qualify for the best terms when opportunities arise. This isn't about gaming the system—it's about understanding the system and positioning yourself strategically.

Real-World Capital Stack Case Study: $8.5M Multifamily Acquisition

Let me walk you through a recent transaction we structured to illustrate these principles in action.

Property Profile:

64-unit multifamily property, Inland Empire, CA

Purchase price: $8.5 million

In-place NOI: $550,000 (6.47% cap rate)

Pro forma NOI: $680,000 (8% cap rate post-improvements)

Value-add strategy: Unit upgrades, improved management, expense reduction

Challenge:

The sponsor had strong operating experience but limited liquidity. Traditional 75% LTV financing would require $2.125 million equity—more than the sponsor could raise without significant dilution.

Solution: Strategic Capital Stack

Layer 1 - Senior Debt:

Amount: $5.5 million (64.7% LTV)

Rate: 6.75%, 30-year amortization, 10-year term

Lender: Regional bank with multifamily focus

DSCR: 1.35x (conservative underwriting)

Annual debt service: $408,000

Layer 2 - Mezzanine Debt:

Amount: $1.2 million (14.1%)

Rate: 11%, interest-only, 5-year term

Lender: Private credit fund

Annual cost: $132,000

Subordinate to senior debt

Layer 3 - Preferred Equity:

Amount: $1 million (11.8%)

Preferred return: 9% annually

Structure: 8% current pay, 1% accrued

Source: Family office investor

Annual distribution: $80,000 (plus $10,000 accrued)

Layer 4 - Common Equity:

Amount: $800,000 (9.4%)

GP contribution: $80,000 (10%)

LP capital: $720,000 (90%)

Profit split: 70/30 (LP/GP) after 12% IRR hurdle

Total Capital Stack: $8.5 million

Total debt: $6.7 million (78.8%)

Total equity: $1.8 million (21.2%)

Year 1 Cash Flow Distribution:

In-place NOI: $550,000

Senior debt service: -$408,000

Mezzanine interest: -$132,000

Preferred current pay: -$80,000

Residual: -$70,000 (shortfall funded by reserves)

Year 3 Cash Flow Distribution (Post-Stabilization):

Pro forma NOI: $680,000

Senior debt service: -$408,000

Mezzanine interest: -$132,000

Preferred current pay: -$80,000

Residual to common equity: $60,000 (7.5% cash-on-cash return)

Year 5 Exit (Sale at 7.2% cap rate):

Sale price: $9.44 million ($680K NOI / 7.2%)

Senior debt payoff: ~$5.3 million

Mezzanine payoff: $1.2 million

Preferred equity (return of capital + accrued): $1.05 million

Transaction costs: ~$350,000

Net proceeds to common equity: $1.54 million

Common equity returns:

Initial investment: $800,000

Exit proceeds: $1.54 million

Total return: 92.5% (5-year hold)

IRR: ~14%

Strategic Outcome:

By layering capital strategically:

Sponsor minimized equity requirement

Senior lender achieved conservative 64.7% LTV (highly secure)

Mezzanine lender earned strong 11% fixed return

Preferred equity investor received steady 9% return with principal protection

Common equity achieved attractive mid-teens IRR despite limited cash flow in early years

This is capital stacking mastery—structuring deals where every layer wins by understanding risk, return, and positioning.

The Capital Stacking Mistakes That Cost Millions

Over 30 years, I've seen even experienced investors make these costly errors:

Mistake #1: Overleveraging with Senior Debt

Pushing LTV above 80% to minimize equity creates a fragile structure. One market downturn, one major tenant departure, one unexpected expense—and you're underwater.

Fix: Cap senior debt at 75% LTV. Use mezzanine or preferred equity to reduce equity requirement while maintaining downside protection.

Mistake #2: Ignoring Interest Rate Risk

Taking floating-rate debt when rates are rising can destroy returns. A 300 basis point rate increase on $5 million debt adds $150,000 in annual costs.

Fix: Purchase interest rate caps, negotiate fixed-rate periods, or model 200-300 basis point increases in your underwriting.

Mistake #3: Misaligning Capital Sources with Hold Period

Using 3-year mezzanine debt on a 7-year value-add deal creates a forced refinance at Year 3—potentially in an unfavorable market.

Fix: Match debt maturities to your business plan timeline. Build in 1-2 year extensions for flexibility.

Mistake #4: Underestimating Equity Dilution

Raising too much preferred equity or giving away excessive GP promote can leave common equity holders with minimal returns even when deals perform.

Fix: Model multiple capital structures. Calculate common equity returns at various exit scenarios. Ensure alignment between capital structure and return objectives.

Mistake #5: Poor Communication with Capital Partners

Surprising mezzanine lenders or preferred equity investors with bad news leads to conflicts, forced asset sales, and destroyed relationships.

Fix: Establish transparent reporting cadences. Share challenges early. Engage capital partners in solution development.

Conclusion: From Capital Consumer to Capital Architect

Capital stacking isn't just a financing technique—it's a fundamental shift in how you think about building wealth through real estate and business.

When you understand how to layer capital strategically, you stop being a price-taker who accepts whatever terms lenders offer. You become a strategic architect who designs optimal structures that maximize returns while managing risk.

You access deals you couldn't afford with single-source financing.

You create asymmetric upside for yourself and your equity partners.

You build portfolios instead of accumulating individual assets.

You transform from an investor into an operator who thinks like an institution.

This is the difference between building a business and building a legacy.

After 30+ years of structuring transactions, I can tell you with certainty: The investors who master capital stacking don't just outperform in good markets. They survive downturns, capitalize on distress, and build generational wealth through strategic discipline.

The question isn't whether capital stacking works. The question is whether you're positioned to use it.

Ready to Master Your Capital Stack?

At Summantis, we specialize in helping investors, entrepreneurs, and business owners access and structure capital with the precision of institutional operators.

Whether you're seeking to:

Structure your first syndicated acquisition

Optimize an existing portfolio's capital stack

Position yourself for commercial financing

Layer multiple funding sources strategically

We provide the guidance, frameworks, and execution support that transform capital from a barrier into a strategic advantage.

Schedule Your Capital Strategy Consultation with María Elena Hernández:

📞 (661) 213-9152🌐 www.summantis.com

Summantis. Prosperity Designed.

Sources & References:

Wall Street Prep - Capital Stack Analysis & Modeling

Northmarq Commercial Real Estate Capital Markets

J.P. Morgan Commercial Real Estate Finance

CrowdStreet Real Estate Investment Education

LoopNet Commercial Real Estate Finance Metrics

Origin Investments - Private Equity Real Estate

Industry standard LTV, DSCR, and debt yield benchmarks

Summantis proprietary transaction data and case studies

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, legal, or investment advice. Capital stacking involves complex financial structures and significant risk. Always consult with qualified financial, legal, and tax professionals before making investment decisions or structuring financing arrangements.

Comments